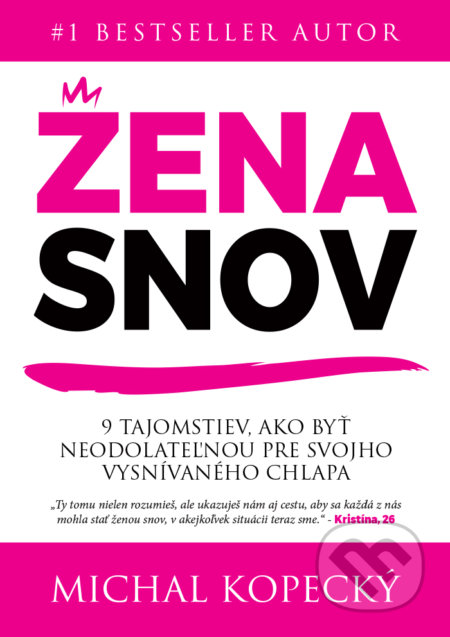

Odhaľ tajomstvo neodolateľnosti

Ženy snov. Staň sa ženou, po ktorej bude chlap túžiť od prvého momentu a už nikdy nebude chcieť inú. Získaj návod, ako sa stať šťastnou a spokojnou ženou s pevnými zásadami a vysokými nárokmi na svojho vysnívaného chlapa počas celého vzťahu. Nauč sa, ako si vážiť samú seba a dať chlapom iba to, čo si zaslúžia.

V čom bude kniha pre teba prínosom?

- Dokážeš ukončiť neperspektívny vzťah a vykašľať sa konečne na chlapa, s ktorým to nemá viac zmysel, aby si dala priestor niečomu novému a lepšiemu.

- Získaš potrebné sebavedomie k tomu, aby si ťa chlapi vážili, mala si sa rada a verila si si, že aj ty dokážeš mať v živote po svojom boku úžasného partnera, s ktorým prežiješ dlhý a šťastný život.

- Staneš sa spokojnejšou a šťastnejšou a vytvoríš si život, ktorý ťa napĺňa a dodáva šťavu a radosť každej jednej bunke tvojho tela - aj mimo chlapa.

- Budeš vedieť zaujať chlapa už na pohľad a upútaš jeho pozornosť od prvého momentu, ako ťa uvidí.

- Dozvieš sa, akú ženu vlastne chlapi chcú a aká by si mala byť na začiatku zoznámenia, počas randenia či vo vzťahu, aby mal chlap pri tebe všetko, čo potrebuje a na inú ani nepomyslel.

- Vybuduješ svoju hodnotu a vytvoríš svoju neodolateľnú ponuku, vďaka čomu budeš skvelým úlovkom aj pre tých vysokohodnotných chlapov, o ktorých máš ty záujem.

- Aj keď si silná žena, naučíš sa, ako dať chlapovi priestor ľúbiť ťa a byť pri tebe chlapom, vďaka čomu už nebudú z tvojho života chlapi utekať (a nie je to tým, že sa ťa boja!)

- Nastavíš si hranice, pevné zásady a vysoký štandard, vďaka čomu ťa budú chlapi rešpektovať a nepodľahneš zbytočne chlapovi, ktorý za to nestojí, nemyslí to s tebou vážne či iba hrá s tebou hry.

- Budeš pre chlapa neustále výzvou, bude ťa dobývať a bude o teba bojovať, prestaneš sa dávať chlapom lacno a už nikdy nedáš chlapovi to, čo si sám nezaslúži.

- No a vďaka tomuto všetkému už viac nebudeš do svojho života priťahovať zúfalcov, chudákov, klamárov či psychopatov, ktorí iba márnia tvoj drahocenný čas, ale staneš sa vysokohodnotnou ženou a pritiahneš si presne ten typ chlapa, o ktorého máš TY záujem a ktorého si zaslúžiš.

Mojím cieľom je dať ženám, ktoré si nevedia nájsť, získať a udržať svojho vysnívaného chlapa do rúk návod, ako sa môžu stať Ženou snov a nájsť svoju spriaznenú dušu.

Teším sa, keď si knihu prečítaš a napíšeš mi, čo priniesla tebe.

Michal